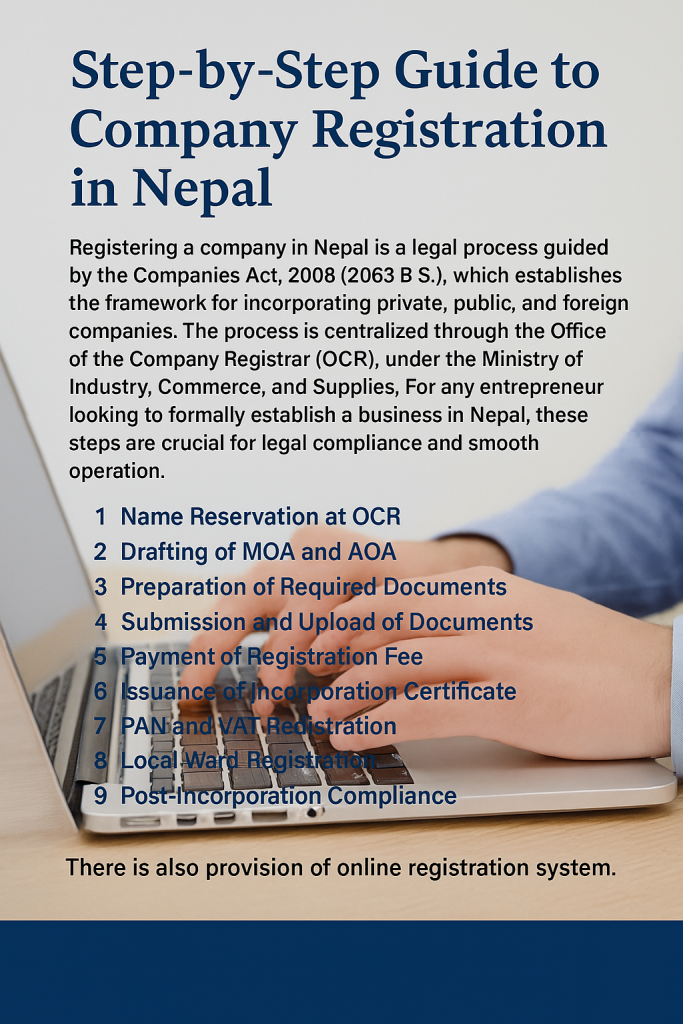

Registering a company in Nepal is a legal process guided by the Companies Act, 2006 (2063 B.S.), which establishes the framework for incorporating private, public, and foreign companies. The process is centralized through the Office of the Company Registrar (OCR), under the Ministry of Industry, Commerce, and Supplies.

In Nepal, there is also a provision of an online registration system. Entrepreneurs can conveniently complete most of the registration steps through the Office of the Company Registrar’s online portal. It ensures faster, more accessible registration and simplifies document submission, name reservation, and fee payment, offering a user-friendly experience for both local and foreign businesses.

For any entrepreneur looking to formally establish a business in Nepal, these steps are crucial for legal compliance and smooth operation. This step-by-step guide outlines the general procedures applicable to all types of companies:

1. Name Reservation at OCR

The first step is to reserve your company name online through the OCR portal. The name must be unique and must include a legal suffix like “Private Limited” or “Limited.” OCR checks for duplication and approves the name. Once approved, the name is reserved for 35 days.

2. Drafting of MOA and AOA

Once the name is reserved, you need to prepare the Memorandum of Association (MOA) and Articles of Association (AOA). The MOA defines the company’s objectives and capital. The AOA explains how the company will be managed internally. These documents are essential and legally required under the Companies Act, 2006.

3. Preparation of Required Documents

Promoters must gather several documents. These include citizenship copies, passport-size photos, proof of office address, and consent letters from directors. Foreign companies must provide notarized and translated documents from their parent company, including board resolutions.

As per Section 5 of the Companies Act, required documents are:

- Citizenship or passport copies of all promoters and directors

- Passport-size photographs

- Registered office address (e.g., utility bill, rental agreement)

- Share structure and promoter details

- Director consent letters

- Power of attorney (optional but useful for third-party registration)

4. Submission and Upload of Documents

All documents must be uploaded to the OCR’s online portal. You must fill in digital forms with company details and upload the MOA, AOA, and other documents. After submission, OCR officials review everything.

5. Payment of Registration Fee

The registration fee depends on the authorized capital of your company. You must deposit the fee at a designated bank and submit the payment voucher to OCR. This payment is necessary for document verification.

6. Issuance of Incorporation Certificate

Once the documents and fees are verified, OCR issues the Certificate of Incorporation under Section 9 of the Companies Act. This certificate gives your company legal status. You can now start business operations in Nepal.

If you’re a foreign investor, you also need approvals from:

- Department of Industry (DOI)

- Investment Board Nepal (IBN) – if your investment exceeds NPR 6 billion or falls under a prioritized sector

- Nepal Rastra Bank (NRB) – for repatriation and currency approvals

This process can take 2 to 6 months, depending on the type and size of the investment.

7. PAN and VAT Registration

After incorporation, register for a Permanent Account Number (PAN) with the Inland Revenue Department (IRD). If your company’s turnover crosses a certain limit, you must also register for Value Added Tax (VAT). These registrations are crucial for taxation and legal invoicing.

8. Local Ward Registration

You must register your business at the local ward office where your office is located. This local registration helps in getting business permits and makes your company known to municipal authorities.

9. Post-Incorporation Compliance

After incorporation, companies in Nepal must fulfill ongoing compliance obligations such as maintaining statutory registers, holding Annual General Meetings (for public companies), submitting annual returns and audited financial statements to the Office of the Company Registrar, and renewing industry registration if applicable.

They must also comply with labor laws by registering employees under the Social Security Fund and fulfilling regular tax obligations. These post-registration requirements are essential to ensure legal operation, avoid penalties, and maintain the company’s credibility and smooth functioning in the long term.

Conclusion

Incorporating a company in Nepal is a structured and regulated process that ensures businesses operate within the country’s legal and regulatory framework. From the initial step of reserving a company name to ensuring full legal and tax compliance, each phase of the registration process is crucial to establishing a legitimate business entity. The Office of Company Registrar (OCR) plays a central role in facilitating the smooth registration of companies, and with the introduction of its online portal, the process has become more efficient, transparent, and accessible to entrepreneurs.

Whether you’re starting a local business or expanding a foreign branch, adhering to the legal requirements ensures that your company operates within the bounds of the law, safeguarding both your business interests and reputation. Additionally, understanding the underlying laws, such as the Companies Act, 2006, and complying with relevant regulations related to taxation, foreign investment, and labor, provides a strong foundation for sustainable and professional operations in Nepal.

By following the outlined steps, entrepreneurs can mitigate potential legal issues and create a solid, credible foundation for their businesses. This not only ensures compliance but also fosters trust among investors, customers, and other stakeholders, contributing to the long-term success and growth of the company in Nepal’s evolving business environment.

- By admin